Bitcoin’s Price History Reveals The Unusual Importance Of November Thirteen

Some individuals would attempt to say, „Well Bitcoin isn’t large sufficient to be thought of eligible to be a macro asset, which I believe is a bit of foolish. I’d say, absolutely. Now, we are able to use these two to find out how much was the typical daily transaction fees. Nic Carter: In fact, yeah and i imply we actually haven’t seen a lot of that uncertainty resolved because the SEC has been actually standoffish by way of doing anything concerning the ITOs. Nolan Bauerle: So with all of this, I assume you would say uncertainty. Nolan Bauerle: And bringing us back to the world of non-public issuance of money that was so prevalent before the federal reserve in 1912 and was really widespread in the United States for a hundred years before that. When using a custodial wallet, you’re entrusting a 3rd social gathering to carry your private key.

Some individuals would attempt to say, „Well Bitcoin isn’t large sufficient to be thought of eligible to be a macro asset, which I believe is a bit of foolish. I’d say, absolutely. Now, we are able to use these two to find out how much was the typical daily transaction fees. Nic Carter: In fact, yeah and i imply we actually haven’t seen a lot of that uncertainty resolved because the SEC has been actually standoffish by way of doing anything concerning the ITOs. Nolan Bauerle: So with all of this, I assume you would say uncertainty. Nolan Bauerle: And bringing us back to the world of non-public issuance of money that was so prevalent before the federal reserve in 1912 and was really widespread in the United States for a hundred years before that. When using a custodial wallet, you’re entrusting a 3rd social gathering to carry your private key.

Bitcoin Cash development has been rising wildly over the past yr between third party providers and infrastructure. Therefore, during the last 5 years, November 13 has twice marked the start of an upward and twice of a downward move. 0.0190 level and just lately started a contemporary upward move. Nolan Bauerle: Which I suppose, de-facto raises it up to the extent of being a macro asset as a result of that’s the whole level. Nolan Bauerle: And there are some fairly troubling qualities of the, let’s say traders and investors using then Nikkei, it’s not as deep as it once was, that’s for certain.

From studying previous technological shifts we all know that there are distinctive methods of tech adoption: Innovators, early adopters, early majority, late majority, and then the laggards. And institutional curiosity then actually began, apparently not with the money however with the blockchain-not-crypto trend. So if something, that’s the interesting factor concerning the yr 2019. Maybe the emergence of Libra as nicely really piqued the curiosity of numerous central banks. Why the emergence of Libra piqued the curiosity of central banks and sovereigns in bitcoin and the cryptocurrency trade more broadly. Nic Carter: It’s kind of at all times had political goals, but sovereigns haven’t really cared about it until now.

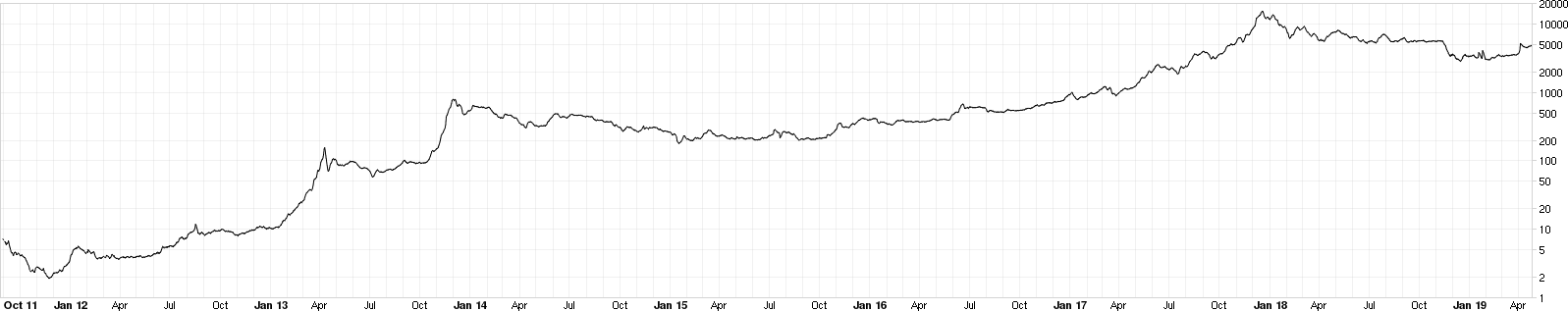

- 2017 – 2018

- The fast-time period risks to bitcoin within the case of a world recession

- 50 Pages Posted: 23 Apr 2011 Last revised: 18 Aug 2014

- 2015 – 2016

- Has a Money Services Business standing in FinCEN

On Twitter, it’s 330 million. An evaluation of the primary 36,289 mined blocks showed that one miner, believed to be Nakamoto, had accumulated over 1 million Bitcoins. Nic Carter: Well, initially, thanks for having me on the present, Nolan. Nolan Bauerle: Safe haven to those that haven’t any other recourse, I suppose. Nolan Bauerle: Mm-hmm (affirmative), Mm-hmm (affirmative), to verify it keeps rising. Nolan Bauerle: We’ve I guess you would say rumors of an actual recession coming to America. There’s this actual cult of passive investing with the idea that the inventory market will just reliably return eight percent nominal, 6 % actual yearly in perpetuity. Why the realized capital of bitcoin is at an all-time high, even if market cap is way off.

It’s plausible to me that the US simply undergoes sort of a Japanification, whereby you’ve extremely free financial policy, even looser than we have in the present day. From its habits, have you seen it behave as a safe haven asset, given all the kind of tribulations we’re seeing at the moment? So we are able to outline it as a macro asset, superb because of what’s around it, but its habits really would push it into the threshold of whether or not it’s a safe haven asset.

For those who have just about any questions regarding exactly where in addition to the way to utilize Wallet Security, you possibly can e-mail us with the web-page.

Hotel Heckkaten