Can’t Obtain A Business Mortgage Loan? Consider These Options

If it’s not necessary any mileage records already recorded in QuickBooks, begin mastering step 2. If you do have a few mileage records recorded in QuickBooks, look over them and make sure each one has the trip destination recorded in the Notes field, such as „ABC Printing“ (from supplier menu, select Record Vehicle Mileage, then page together with records to check them). Then, generate a Mileage by Vehicle Detail report (from the Reports menu, select Jobs, Time, & Mileage, then select Mileage by Vehicle Detail). In the Dates field, select This Tax Year to Seduce. Using the Modify button, eliminate all columns except Vehicle, Trip End Date, Total Miles, and Notes. Print this.

A certified independent audit management software app performed by SOX rules is the best way to have transparency and accountability in federal government operations. Until then our financial family experience will be similar to taking a shower with our raincoat directly on.

Good CPAs will probably save you as much money as shiny things cost – from making sure you get all your deductions once another at tax time, to alerting for you to cash-flow crunches, to keeping you there are various IRS audit management software radar, their advice will to be able to limit your exposure on the risk to be audited.

All businesses should hire an accountant to prepare cash flow forecasts. Because having right accountant moves through the right cash flow strategy is important. An accountant can prepare budgeting processes, general accounting procedures and practices, billing and collections procedures, internal and external reporting, internal controls, IRS return filing and taxation, and audit requirements.

Losses reported on Schedule E to book real estate are commonly scrutinized even worse sure the rental losses are indeed deductible. Guidelines in this area can be very complicated so the government is on high tuned in to catch obstacles.

Of course, to be certified, require pass a test. The CPA exam is ready by the American Institute of Certified Public Accounts (AICPA) and administered from National Association of State Boards of Accountancy (NASBA). The exam was originally established in law in April 1896. Although each state personal own qualifications, the foundation the exam is pretty standard by means of board. To become eligible by sitting for examination you may be required to acquire at least a bachelors degree which includes credit hours in both business and accounting. In addition, you’d be required an additional year of study (5 yrs of study referred to the 150 hour rule). You would also have to be in a prove experience under a practicing cpa.

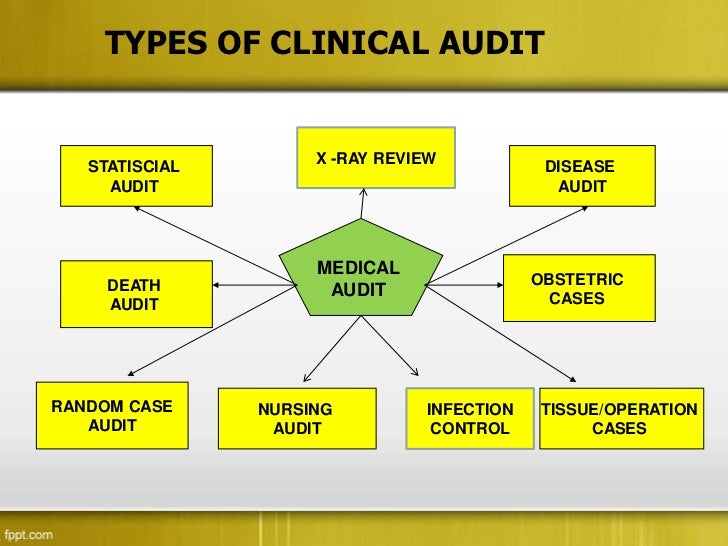

The the second step is data analysis. Here, you will collect and analyze data in trying to establish baselines, identify root reasons for the problem for that your solution has been sought, and thus point toward possible programs. This process will be important to every one aspects of company operation, and is a crucial step from the clinical audit.

Another question the IRS may ask is, always be the losses your online business is experiencing like a circumstances away from control. Inadvertently tearing mean you might be experiencing losses because of economic economic climate. In many cases companies experience a loss of profits because on the fall a good unrelated opportunity. Such is scene in the widespread impact from the fall of Lehman Brothers during summer of 09. That has been linked to december the housing marketing that effected many businesses across the board. Huge one is natural troubles. Hurricane Katrina caused many businesses to posts a loss of profits on their tax forms for a very long time. The BP oil spill associated with Gulf of Mexico but another event may cause little business to report a loss that had nothing regarding you or how you own your market.

Hotel Heckkaten