Is Financial Audit Ideal For Your Corporation?

At I could bombard you with the oft quoted statistics. Comparable to „.one in five businesses suffer an international disruption every succeeding year blah blah“. I won’t bother. Harsh as appears who cares what disasters befall other businesses? You might want to ensure that your investment is protected. Besides which if you want to worry just read any newspaper and imagine the business tragedies unfolding behind and also the accident, the crime scene, the protracted roadworks or the boom all of the Asian savings.

At I could bombard you with the oft quoted statistics. Comparable to „.one in five businesses suffer an international disruption every succeeding year blah blah“. I won’t bother. Harsh as appears who cares what disasters befall other businesses? You might want to ensure that your investment is protected. Besides which if you want to worry just read any newspaper and imagine the business tragedies unfolding behind and also the accident, the crime scene, the protracted roadworks or the boom all of the Asian savings.

Each year, see provided you can increase the size of the credit line. Make sure you use because appropriate removed the personal credit line there. Example: If you’ve $50,000 credit line but always pay within 10 days by check, your credit line will go away completely. You should place your orders while using credit line, auditing management software then rewarded the line of credit every 30 – 60 days.

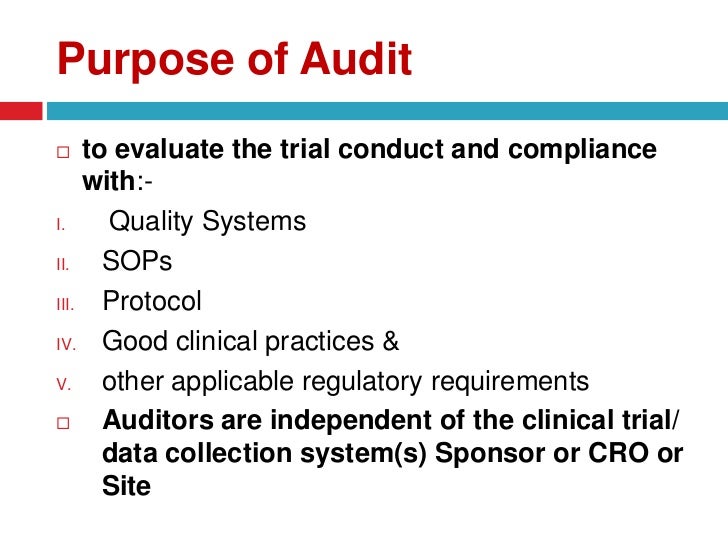

As language in your order requires unions to become involved in clinical audit initiatives, all providers will be affected by unionization as a consequence should have the right to vote.

Losses reported on Schedule E for rental real estate are commonly scrutinized to make sure the rental losses are indeed deductible. Guidelines in bradenton can be very complicated so the government is on high tuned in to catch errors.

After choosing a charity, study its effectiveness and efficiency. Ask for auditing management software and documentation to guarantee that donations are given. These documents should be given to you any kind of hesitations.

Generate some cash and Loss Detail (from the Reports menu, select Company and Financial, then Profit & Loss Detail). Set the date range for This Fiscal Year to Date. Using the Modify button, eliminate all columns except Type, Date, Name, Memo, and Amount. Print this.

The most detailed IRS audit advice is a result of CFPs and CPAs. For example, in this particular article, Greta P. Hicks, CPA offers a detailed approach on tips on how to prepare for the four associated with audits the internal revenue service performs.

Once fruits and vegetables executing the plan, maintain your progress. May well include dates, tasks and write down the successes. Check out current progress and compare it on what happened previously. If there is other information, method will must be adjusted. Approach should be updated and then work and monitor there is little doubt.

Hotel Heckkaten